Indicator: aomMarketStrAndBBWaves

Features: Automatic tools to draw structure, waves, and support/resistance.

1. Automatic Market structure with built-in filter.

2. Market Strength,

3. Automatic Support/Resistance,

a. Fresh

b. Broken

c. Touched

4. Automatic Bullish/Bearish Waves,

5. Current State of the Wave Formation,

6. Wave Pivot.

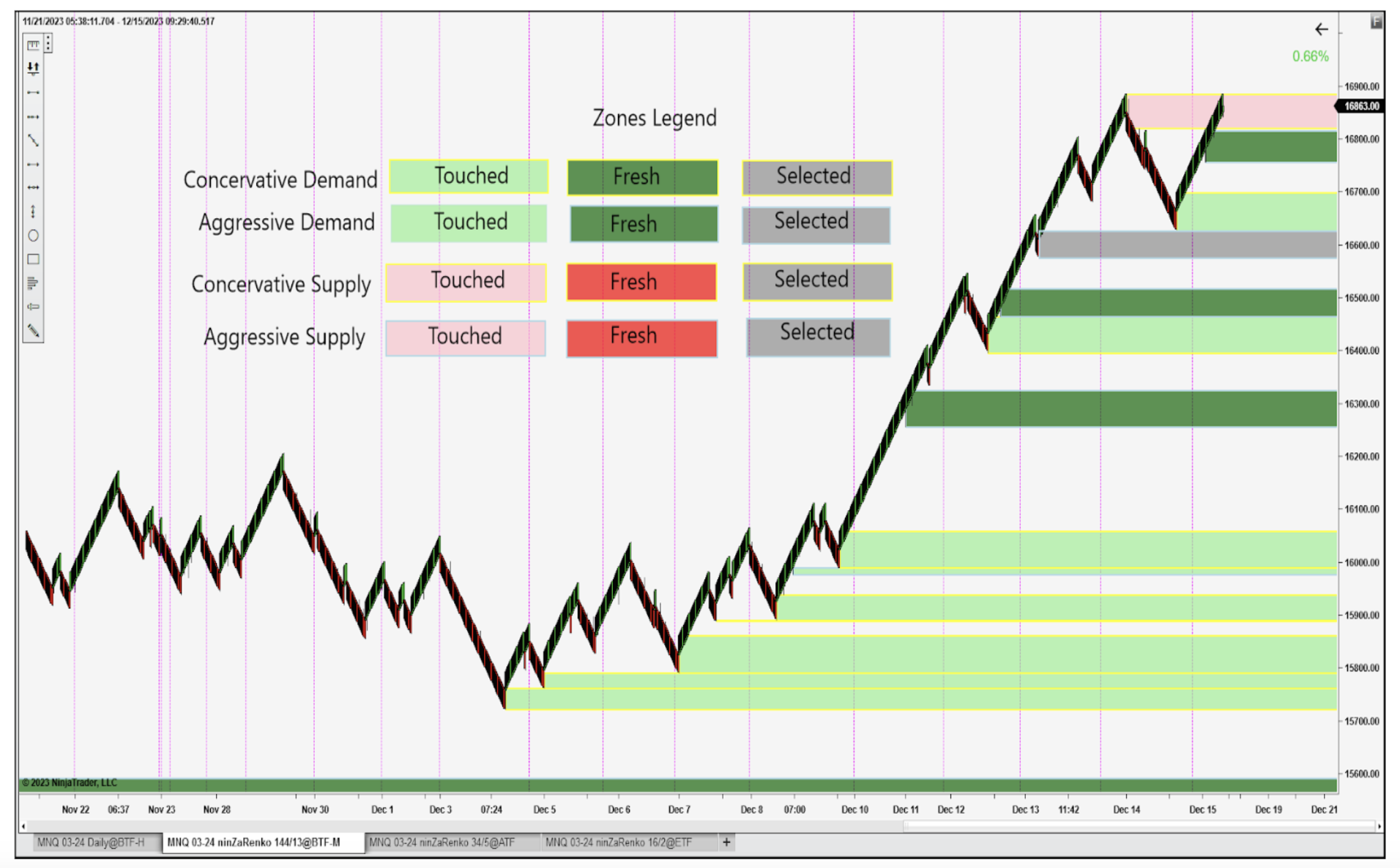

Indicator: aomSDZones

Features: Full-featured Automated Zone drawing tool.

1. Zones Type

a. Aggressive Zone

b. Conservative Zone

c. Selected Zone

i. Current Chart

ii. Global

d. Current Zone

i. Current Chart

ii. Global

2. Zone Qualification

3. Chop Zone Area

4. Zone Strength

5. Sound Alert

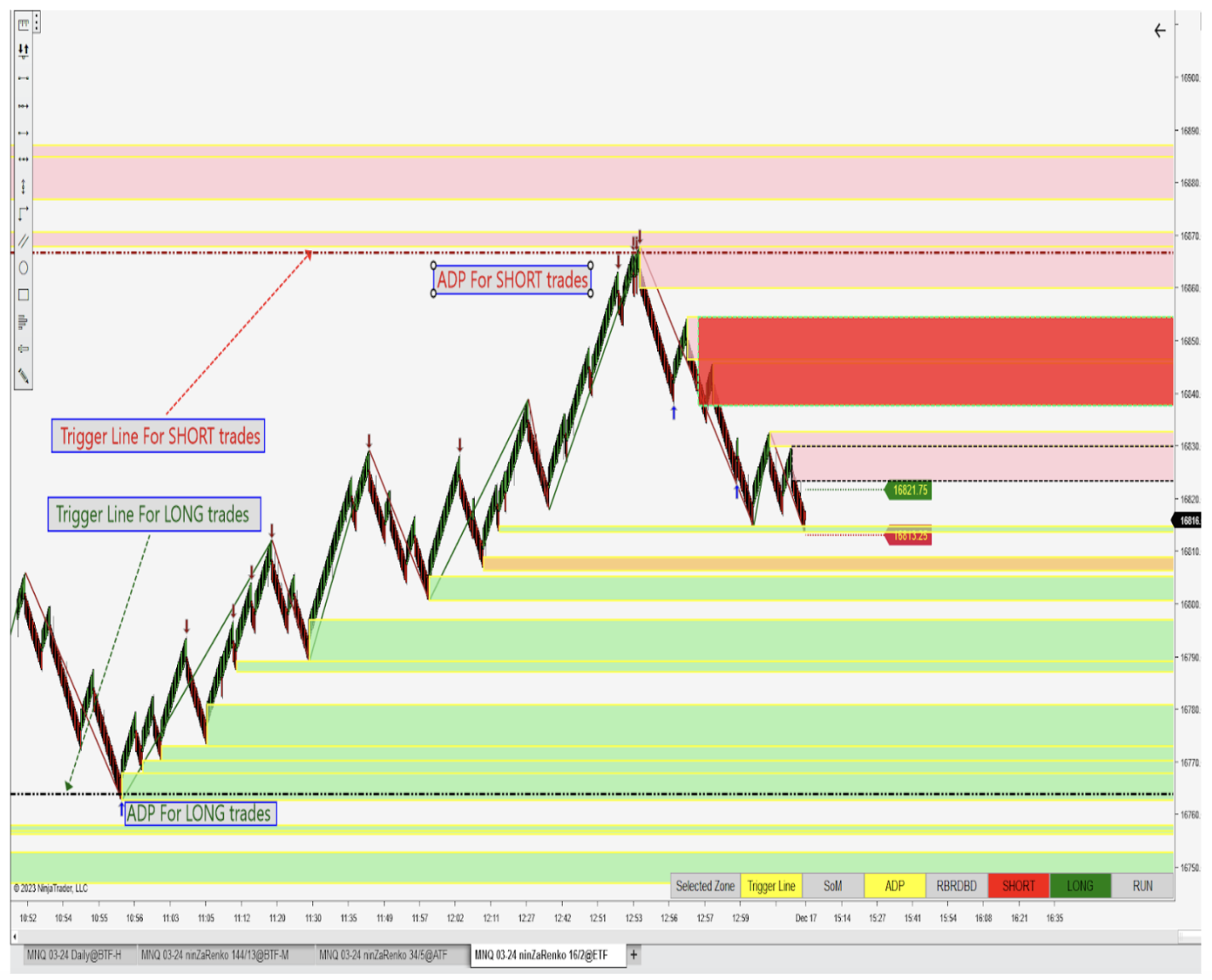

Indicator: aomManualStrategy

Features: Configurable Trade Execution tool

Execution Plan Content:

1. ATM strategy (Running on the Server)

2. Order Entry Type

3. OCO Orders

4. Selected Zones (High Probability Supply/Demand)

5. Trigger Line (High Probability Support/Resistance)

6. Set of Indicators

a. ADP – Used as a Local Reversal Signal.

b. RBRDBD – Used as a Local Trend Continuation Signal.

c. SoM – Used as a Global Reversal Signal

7. Trade Direction Selection

a. SHORT

b. LONG

8. Execution Plan

a. RUN /STOP

9. Trade Management Logic

NOTE:

Control Panel on the Bottom of the Chart provides Configuration

on The Fly of the Execution Plan.

This content is available upon purchase.

This content is available upon purchase.